Asset Allocation 101

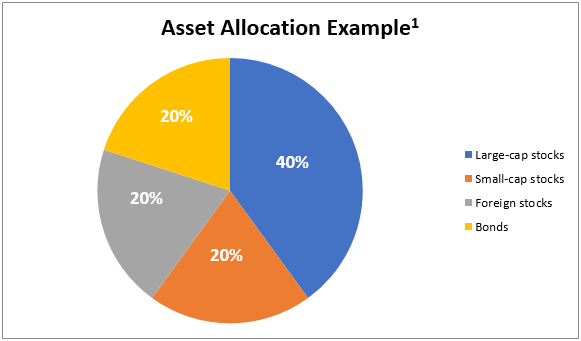

Asset allocation is a common investing strategy that helps you reduce the overall risk associated with your investment holdings (such as mutual funds). The basic idea is that you allocate – or spread – your investments across a diversified portfolio of investments. For example, equities and bonds may not always gain or lose money at the same time or in the same magnitude. By investing in different types of mutual funds (diversifying), you reduce overall risk and give yourself additional opportunities for positive returns.

To address the importance of diversification, BenefitWallet offers several low-fee Institutional Class mutual funds. These funds are comprised of varying asset classes such as large, mid- and small-cap U.S. equities (stocks), real assets, international equities and several types of U.S. fixed income (bond) funds. This allows you to build a well-diversified portfolio of investments in your HSA. Please note that BenefitWallet is not recommending any investing strategy and you should address specific questions and fund selection with a qualified, independent investment professional.

Active vs. Passive: You Choose

Your HSA investing options include both actively managed and passive funds from which to choose. This gives you the flexibility to either build your own portfolio of holdings or simply choose to reflect key market indices (large cap, small cap, etc.). Regardless of which funds you choose, all BenefitWallet funds are Institutional Class and free from loads (no commission or sales charge when sold) and transaction fees (so you can buy and sell funds without a fee). This keeps your overall expenses down and helps maximize your returns.

An active fund is managed by a portfolio manager who actively seeks to return more to investors than the corresponding market index. A portfolio manager is making decisions on which stocks or bonds to buy based on their own analysis. These funds typically have slightly higher expense ratios (investment management fees) to help offset the cost of the fund manager.

Passively managed funds are less subjective and attempt to match the performance of a specific market index. The index is typically managed by a third party and contains a bundle of stocks or bonds that are meant to represent broad market exposure in that asset class. For example, the Vanguard Small Cap Index fund within the HSA investment portfolio follows the US Small Cap Index. When changes are made to the Small Cap Index, Vanguard must buy or sell those same stocks or bonds to reflect the changes of the Index.

Typically, passive funds have lower expense ratios. Costs are lower for administering passive funds because less research is required on the part of the portfolio manager. As a result, less portfolio value is consumed by investment management fees. With actively managed funds, investors are paying a portfolio manager for specialized research with the expectation that the managed funds will outperform the market. However, since there is no guaranteed performance when it comes to mutual fund investments, you should conduct your own research or work with a financial professional to select the funds best suited to your goals.